By Kent Garber

Posted July 1, 2009

In 2007, a standoff unfolded between China and several American companies, including W.R. Grace, a major supplier of oil refining products. China was threatening to withhold supplies that keep refiners in business.

A worried State Department intervened. By then, W.R. Grace had only a three-month supply of the special metals it needs for its refining products. Because the metals come almost exclusively from China, if the government had not acted, sources say, oil refineries could have been forced to shut down, possibly triggering shortages across the country.

The metals W.R. Grace needed belong to a group known as "rare earths." They are the backbone of the Information Age and, potentially, the clean energy future. They are in iPods, Blackberry’s, and plasma TVs. They are powerful and compact; they are exceedingly efficient. In many cases, there are no substitutes. On the periodic table, they have their own section, 17 metals in all, reflecting their unique atomic structure.

Fifty years ago, the world's economy was built on steel, aluminum, and iron. Today, rare-earth metals are reshaping it. But they are not easy to acquire, not anymore. In the 1970s and 1980s, the United States was the world's leading producer. Today, China provides nearly 97 percent of the world's supply. It has a near monopoly, and it is cutting exports.

Dominance. The strategic implications of this growing imbalance are vast, particularly for defense and energy. Wind turbines and electric cars have become clean energy symbols, but they are merely final products, the visible results of a supply chain that spans international borders and, for the most part, is largely overlooked by policymakers. At the bottom of this chain, at its most basic level, are rare-earth metals mined from the Earth's crust and made into magnets or other parts, then put into motors or batteries.

China's dominance in this arena, and its displacement of American leadership, are not accidental. In 1992, Deng Xiaoping, then the country's most powerful politician, outlined a plan. "The Middle East has oil; we have rare earths," he said. "We must develop these rare earths." Today this phrase is emblazoned, like a campaign slogan, across the roof of at least one Chinese factory.

Deng's call to arms has been carried out nearly flawlessly. China dominates the world market and in recent months has taken control of mines in Brazil and Australia, thereby eliminating potential competitors. It is poised to do with rare earths what the Organization of Petroleum Exporting Countries has done with oil: make the world dependent. In 2002, China exported about 60,000 tons of rare-earth metals. In 2008, it exported about 45,000 tons. In 2009, based upon preliminary estimates, that will drop into the 30,000s.

The slide will most likely continue, with potentially serious implications for President Obama's energy goals. In 2008, an Australian analyst named Dudley Kingsnorth released a report in which he calculated that China's rare-earth supplies could become off limits to the world as early as 2012. The severity of Kingsnorth's projection has been questioned by some, and the global recession has probably pushed the date back a few years. But the general trend holds. Resource production is limited, and China's internal demand is soaring, fueled by consumers and new energy ambitions. Within five years, China wants to be the world's leading manufacturer of wind turbines and electric batteries.

Global demand for rare-earth metals, meanwhile, is expected to grow at least 10 percent annually. If no new mines open, the scenarios are daunting. At best, if China continues exporting, global prices seem sure to rise. At worst, the West could be shut off altogether, left scrambling to find new sources of these metals for turbines, batteries, and other parts. "The very basic question is 'Are we going to trade dependence on Mideast oil for Chinese rare earths?' ”says Jeff Green, a lobbyist who specializes in metals. ”I think the answer is 'Probably.' "

Falling behind. This is not just a story about metals, though. It is also a story about decline and innovation, about what has happened to American manufacturing, and about the gap that exists between where the country's political leaders want to go—to a "clean-energy economy," with thriving factories and state-of-the-art research facilities—and where some industries stand today.

That the United States was once the leader in this field is a fascinating byproduct of the country's nuclear past. In the aftermath of World War II, with the Cold War setting in, U.S. officials were terrified that the country would run out of uranium. So they began encouraging prospectors to look for uranium deposits.

Radioactive materials were rarely found alone. They came with other metals, like rare earths. This was the case at Mountain Pass, Calif., in the Mojave Desert, where the world's largest rare-earth mine opened in the early 1950s. Thus began a nearly half-century reign for the United States. By the late 1960s, Mountain Pass was the world's leading supplier of europium, a rare-earth metal that creates the red color in color TVs. The mine's owner, Molycorp, poured millions into research.

By the mid-1980s, China wised up. The terrain of Inner Mongolia, where there was already extensive iron mining, became ground zero for a new venture. Backed by a deliberate national push, rare-earth production boomed.

China's rise eventually triggered the end of a proud chapter of American innovation. But this fate was not immediately apparent. A poignant example involves General Motors. In the early 1980s, GM scientists invented a new way to make magnets. Rather than use pure magnets, they developed a magnetic powder, which they could mix with rubber and inject where needed. This powder, like many high-performance magnets, required neodymium, a very strong rare earth. With the powder, less metal was needed, so car parts could be lighter—in the auto industry, a good thing. GM's magnet division got its own name, Magnequench, and a 175,000-square-foot facility was built in Indiana in 1986.

But the timing proved terrible. As the 1980s wore on, China's strip mining accelerated. Production soared, and global prices dropped. American magnet companies began to close down or, seeking cheaper resources, moved to China. In 1995, two Chinese companies, with the help of American investors, purchased Magnequench. The move, a report to Congress later found, was part of a "detailed strategy" by China to control rare earths. To win U.S. approval, the buyers had promised to keep the magnet facility in Indiana. They moved it to China in 2002.

By then the mine at Mountain Pass had fallen idle, hurt by excess supplies and, some say, Chinese competition and fallout from a mid-1990s incident involving a contaminated water spill. This leaves the United States with no active rare-earth mine (although Molycorp continues to process ore it had already dug up at Mountain Pass). Meanwhile, the number of workers in the U.S. high-performance magnet industry has fallen 80 percent over the past decade. Not a single American company today makes neodymium magnets for wind turbines, smart bombs, or anything else.

All this is very likely just the first act of a bigger drama. For the past year or so, Western analysts had been buzzing about the potential opening of a rare earth mine in western Australia by Lynas Corp., an Australian company. Many saw it as potential counter to Chinese dominance, a friendly foothold in an uncertain market. It is a large mine, with the potential to supply a decent fraction of the world's rare earth needs. But in May, hopes faded. Offering $366 million, a company owned by the Chinese government bought a majority stake in the mine. "I think they've worked their plan to perfection," says Ed Richardson of Thomas & Skinner, one of the remaining U.S. high-performance magnet companies. "If we look at how dependent the world has become on rare-earth elements, it's kind of scary. It all happened right under our nose."

An idle mine, niche companies fleeing to China—all this may sound like another case of globalization ills. But it's also a telling example of what's necessary for innovation and economic growth.

In Washington, there is bipartisan support for renewable electricity and next-generation cars, which will require significant innovation. The disagreement is over how to spur it. Republicans favor private investment. Democrats favor public funding and regulations, such as requiring utilities to generate more of their electricity from renewable sources.

Both sides may be missing a key element. Economists generally agree that innovation is a major driver of economic growth. Innovation, however, does not occur in isolation. It is not the product of one company's efforts or of a single lab's work. It is the result of a whole cluster of things, including raw material suppliers, research labs, and manufacturing firms, working together. Remove one of these links, and the innovation chain weakens or breaks.

In the case of American energy technologies, the rare-earth component has been absent for a while. According to a paper published by Brian Fifarek of Carnegie Mellon University last year, its absence has left a mark. As domestic resources have vanished, he found, the number of successful patent applications filed by American companies for technologies using rare earths has declined precipitously since the early 1990s.

There is also anecdotal evidence to suggest that research and development activity, the lifeblood of innovation, has followed resources overseas. In 1999, Magnequench opened a research facility in North Carolina. In 2004, the company, citing access to resources, moved it to Singapore. Another rare-earth facility, in Ames, Iowa, closed in 2002.

Understandably, it has taken some countries and companies a while to make connections between innovation and resources. Mainly, someone in power has to look pretty far down the supply chain, through several layers of middlemen, to spot a problem. In some cases, they haven't or say they don't see problems. "I don't think about it that much," says Siemens CEO Peter Loscher.

But events have started to open some stakeholders' eyes.

In 2005, the Chinese national offshore oil company, CNOOC, made a hostile bid to take over American oil giant Unocal. Congress rejected it, fearing that the Chinese might gain a foothold in the oil-rich Gulf of Mexico. Ultimately, Chevron acquired the company. But many observers now believe China was also after something else: the Mountain Pass rare-earth mine, which Unocal had acquired in the 1990s. "I was getting phone calls from the highest levels of management at Unocal, asking what it would take to sell Mountain Pass," says Molycorp CEO Mark Smith. "I don't think it's too hard to put the two together."

Next was the incident in 2007 in which W.R. Grace and others felt squeezed by China's threat to withhold rare earth shipments. Then, in 2008, prices for all commodities, including rare earths, began to skyrocket. Neodymium jumped from $8 per kilogram to $50 per kg. Suddenly, people became concerned about the supplies of rare earths. The same year, a report by the National Research Council found that shortages of rare earths would have a bigger impact on manufacturers than problems with the supply of any other commonly used metal.

U.S. revival. Can the United States make a comeback? "When you have given up the capacity to innovate and manufacture and build, it is difficult just to buy it back," says Mary Poulton, a geological engineering professor at the University of Arizona and a coauthor of the NRC report. "You've given up a lot of the leads to other countries."

There is first the challenge of reopening a mine; that in itself is difficult enough, requiring money and an appetite for risk. In the business world, mining investments are considered among the riskiest of deals. The full challenge, rebuilding a supply chain, is much greater. Metals have to be purified, refined, and assembled into components. These steps require money, technology, and expertise. In the United States, according to government estimates, there are only three facilities that refine rare earths. Most of the engineers who understand the processes are either retired or dead.

But the start of a revival may be underway. Molycorp is trying to restart mining by 2012. Another company, Thorium Energy, Inc. which owns an enormous swath of land in Idaho's rare-earth-rich Lemhi Pass, is seeking investors. Both Smith and Thorium Energy CEO Ed Cowle have been trekking to Washington to talk to congressmen, senators, and agency officials.

Part of their problem, they say, is getting people to realize there is actually a problem. "This portion of the supply chain is buried deep," says Smith. "You really have to understand this whole supply chain concept. I sit down with car companies and wind turbine companies, and the first response you will get is 'Oh, I don't worry about that. I buy my motors or generators from this company or that company and I didn't know there were rare earths in them.'" As Jack Lifton, a longtime metal analyst, says, "The Chinese are depending, as they always do, on the myopia of the American investment community that only sees to the end of its nose."

Some say the concerns are overblown, that China will do everything it can do to ensure steady exports. And for certain technologies, researchers say there are potential alternatives to rare earths. The leading technology in electric batteries, nickel metal hydride, requires them, but a possible alternative, lithium ion, does not. "Lithium batteries have higher energy and power," says Gary Yang, a scientist at Pacific Northwest National Laboratory. "That is their advantage over rare earths." But lithium ion batteries require years more research.

Nevertheless, a global quest for new mines is dawning. "They are all out looking for money," says Richardson. 'The Canadians, the Australians, Molycorp here in the U.S., Thorium Energy—all these mines are looking for big bucks, but it's high risk." Environmental issues can crop up, as they have in the past for Molycorp. Investors can pull out, as they have in Australia. A new mine will cost hundreds of millions.

On Capitol Hill, interest is tepid but picking up. "Folks are finally starting to say, 'How are we going to advance the ball?' ”says Green.” The Chinese are expected to consume all their production by 2012, 2013, or 2014. I think these needs to cause alarm in the U.S. government." In 2007, supporters managed to secure an earmark for a Defense Metals Technology Center in Ohio, which advises the military on strategic metals.

Last month, Rep. Mike Coffman, a Colorado Republican, slipped an amendment into the House's defense budget bill that would require the watchdog Government Accountability Office to review rare-earth concerns. And Sen. Evan Bayh, an Indiana Democrat, has just proposed requiring the defense department to evaluate the extent to which the country's weapons are dependent upon rare earth metal supplies "that could be interrupted."But that's about it. So far, the focus of most politicians and the American public is still at the top of the supply chain—on the gleaming turbines and electric vehicle prototypes—rather than on the dusty metals at the bottom.

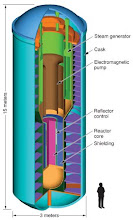

KEYWORD REFERENCE: THORIUM, ENERGY, ED COWLE, ATOMIC, NUCLEAR, RARE EARTH ELEMENTS, ALTERNATIVE FUELS, URANIUM, LEMHI PASS, ALTERNATIVE ENERGY, REACTOR, POWER, MINING, MINERALS, THORIUM, SHIELDING, SMALL REACTORS, KIRK SORENSEN, BLOGS ON THORIUM, NEWS ABOUT THORIUM, NUCLEAR TREATIES, INDIA POWER, THORIUM POWER, SSTAR REACTOR, NUCLEAR SUBMARINES, SALT WATER REACTORS, LIQUID FLORINE,LIQUID THORIUM, ATOMIC ELEMENTS, MINERALS, HADRON COLLIDER, COMMODITIES INVESTMENTS,THORIUM ENERGY, THORIUM POWER, ALTERNATIVE ENERGY, ATOMIC POWER, THORIUM-FUELED REACTORS, ATOMIC ENERGY, NON-WEAPONIZABLE FUEL, COAL, HYDROELECTRIC POWER, BURNING COAL, COAL AND CO2 POLLUTION , HYDRO-ELECTRIC POWER, WIND-POWER, SOLAR POWER, PETROLEUM ALTERNATIVES, OIL PRICES, COMMODITIES, RARE EARTH ELEMENTS, LEMHI PASS, MINING AND MINERALS, RISING OIL PRICES, OPEC, ENERGY INDEPENDENCE, THORIUM POWER IN INDIA, CANADA, CHINA GERMANY, ENGLAND, SWEDEN, SOUTH KOREA, FLORIDE REACTOR, ETHANOL, SHALE, SAND OIL, NUCLEAR SAFETY, THORIUM BLOGS, BIG OIL, THORIUM ENERGY BLOG, URANIUM, REACTOR SHIELDING, PLUTONIUM WASTE, GREEN ENERGY, GLOBAL WARMING, RESOURCES, RESERVES, MINERAL AND MINING CLAIMS, ATOMIC ENERGY, FISSION, FUSION, LFTR, DOUGLAS CASTLE, JACK LIFTON, CLEAN COAL, GREENHOUSE EMISSIONS, ENVIRONMENTAL FACTORS, RADIOACTIVE WASTE DISPOSAL, POLLUTION, GEOTHERMAL POWER, THORIUM-BASED ENERGY, THORIUM TECHNOLOGIES, RARE EARTH ELEMENTS, ENERGY RESOURCES, THORIUM SUPPLIES, REID-HATCH BILL, GREEN POWER, GREEN FUELS, KIRK SORENSEN, LIQUID FLORIDE THERMONUCLEAR REACTOR, TH, THORIUM OXIDES, COMMODITIES FUTURES, NON-PRECIOUS METALS, THE GLOBAL FUTURIST, CLIMATIC CHANGE, BLOGS ABOUT THORIUM, GOOGLE ALERTS ABOUT THORIUM, YAHOO ALERTS ABOUT THORIUM, THORIUM NEWS, INTERNATIONAL ENERGY POLICY, G-8, INDIA'S THORIUM, CLIMATIC CHANGE, BLOGOSPHERE...