The Green Economy/Thorium Energy

Presenting: working solutions for big Problems

Problems:

How to create 5+ million new jobs during the Obama Administration

How to generate these jobs by stimulating the “Green” economy

How to diminish fossil fuel usage

How to save 30-50% of the electrical energy now being lost on the “grid”

How to make US buildings energy efficient without raising monthly budgets or down payments

How to increase every buildings value, utilizing capital now wasted in energy inefficiencies

How every building owner can use all available “green retrofit” tax credits and subsidies

How to preserve our environment and air quality

How to do all of the above and preserve our capitalistic model without raising taxes

Premise:

It would be possible to save 50% of a buildings electrical and/or heating bill by completely retrofitting it with the latest (proven) energy saving technologies such as;

Solar panels (buildings)

Large arrays of solar power dishes (concentrators) per each community

Solar outdoor lighting

Single dwelling wind generators

Large arrays of wind generators per each community

New tech insulation and weather striping

New technology in thermal windows

Energy saving appliances (including; washers/dryers, air conditioning/heaters, refrigerators/freezers, ovens/stoves, lamps/light bulbs etc., etc..

Building owners would be willing to allow this retrofitting to take place if the construction did not involve an increase, of any amount, to their existing monthly budget or require a down payment.

The US government would guarantee a local (15 year) bond issue sufficient to retrofit every building in its community (utilizing financial models that are now commonly employed to build roads, schools and other city or community improvements etc.).

Solutions – Phase I (Immediate action Plan)

Each building’s electrical bills for the previous 10 years are evaluated; the highest annual bill and the lowest annual bill are eliminated. The annual bills for the remaining 8 years are averaged and a “Base Annual Energy Cost (BAEC)” is established.This BAEC is divided by 50% (the amount of the expected energy savings, as described above) and multiplied by the number of years of the bond issue (hypothetically 15 years).

This “saved” money (50% of their existing electric utility bill) would be calculated by the local government entity and used to; hire and/or contract local, unemployed, US citizens to install the energy efficient equipment and measures. US suppliers (with a concentration on local community suppliers) of equipment would submit bids on the equipment portion of the jobs to the local government entity empowered to complete the retrofitting.

This amount of money should be sufficient to cover materials, labor, management, administration including a 1% fee to a consulting firm (oversees all community projects as described above) and to pay the interest on the bond (Excel Spread sheet available).

All amounts and percentages are hypothetical and can be adjusted.

Example; A 3,000 Sq. Ft. building with a Base Annual Electricity Cost of $4,800 divided by 50% (savings) = $2,400 X (15 years – suggested bond period) = $36,000.

Assume; the total bond and administrative expenses as $3,600 with a material cost of $23,400 and labor at $9,000.If this were the average building (including commercial buildings) in a community of 5,000 buildings then; the total bond needed would be $180,000,000, total expenses would be $18,000,000, total material cost would be $117,000,000 and the total labor costs would be $45,000,000.

A community of 5,000 buildings would require 458 crews of 3 or 1,374 workers, working full time for 1 year, all working within the green economy. These workers would now be trained installers and could travel to neighboring communities to train their crews.

As a practical matter this work would probably be completed over a period of 5 or more years by fewer crews thus expanding the employment period.

Suppose that over time we could retrofit 20 million buildings; this would create more than 5,500,000 new jobs; increase the value of each building by about 30,000; save about $180,000,000 annually in fossil fuel and give each family of 4 an annual stimulus of about $2,000. All of this can be accomplished without; raising anyone’s taxes or anyone’s monthly budget and all within the “green” economy.

All numbers are assumptions; participation would be volunteered and dependent upon a pre-inspection for acceptance to the program. Buildings that would be incapable of achieving a 50% savings (even with a higher dollar input) would be tuned down or have their BAEC adjusted. Buildings that are being or have been retrofitted by the owners (and could not achieve an additional 50% savings) would not be placed in the Phase I program or have the BAEC adjusted down. A mortgage lien for the amount expended would be placed on each building for the bond period with monthly payments equal to ½ of their current monthly electric utility bill.

The lien would need to be assumed or settled if the building were sold. Building buyers would be very likely to want to assume a partially paid debt that would guarantee that ½ of their electrical bill was stabilized at a constant (low) price and that the additional equity would pay them back many times over the years. Buildings that had repaid their original bond obligation and that were into Phase II (the Thorium Nuclear bond issue), allowing very inexpensive clean electrical energy, would likely sell at a premium.

Because none of the energy saved comes over the national electrical grid, and due to the fact that as much as 50% of the energy carried over the grid is lost in transmission, an amount of energy is also saved (as much as 30-50%) which would be difficult to measure but is extremely important.

The energy created by solar and/or wind for the building will be substantial and could be critical in the event that the national grid or the local grid should go down for any reason.Solutions –

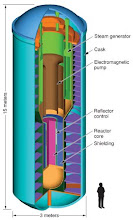

Phase II (Thorium Follow-up Action Plan)

Within 7 years (or upon the final technology approval and acceptance) of the implementation of Phase I, a new guarantee for local community bonds should be issued to employ a “community sized” Liquid-Fluoride Thorium Nuclear Reactor. The costs per capita will be very close to the retrofitting scenario suggested in Phase I and the financial model will remain much the same.

The resultant energy from the installation will be capable of supplying the balance of the electrical energy requirements for the entire community at a measured price far below that of fossil fuel levels with no carbon footprint.

After the completion of Phase II, the local community will have no need to depend on the national grid and the local elected government will operate as the power requirement/management facility (as a community coop). After the Phase II bond debt is paid, the buildings will be billed service charges and for thorium fuel replacement (estimated to be once every 10 years). There will be no need to buy any other electrical energy.

The Safety and Stability Advantages of a Liquid-Fluoride Reactor in the Environment

By; Kirk Sorensen (summarized)

“The generation and use of energy is central to the maintenance of organization. Life itself is a state of organization maintained by the continual use of sources of energy. Human civilization has reached the state it has by the widespread use of energy, and for the large fraction of the world that aspires to a higher standard of living; more energy will be required to achieve it. We should never waste energy, and should always seek to use energy efficiently as possible and practical, but energy itself will always be needed.

This section is about the use of thorium as an energy source of sufficient magnitude for thousands of years of future energy needs. Thorium, if used efficiently, can be converted to energy far more easily and safely than any other energy source of comparable magnitude, including nuclear fusion and uranium fission.”

Thorium nuclear does not lend itself to the proliferation of nuclear weapons and should be acceptable as a world-wide nuclear fuel – India, Norway, Russia, The United Arab Emirates and many other countries are now developing and/or considering thorium nuclear facilities.

“Briefly, the basic principles are:

1. Nuclear reactions (changes in the binding energy of nuclei) release about a million times more energy than chemical reactions (changes in the binding energy of electrons), therefore, it is logical to pursue nuclear reactions as dense sources of energy.

2. Changing the binding energy of the nucleus with uncharged particles (neutrons inducing fission) is much easier than changing the nuclear state with charged particles (fusion), because fission does not contend with electrostatic repulsion as fusion does.

3. Naturally occurring fissile material (uranium-235) will not sustain us for millennia due to its scarcity. We must fission fertile isotopes (uranium-238, thorium-232) which are abundant in order to sustain energy production for millennia,” (Thorium Energy, Inc. has properties in the Lemhi Pass (USA) that could supply the world’s energy needs for centuries.) “Fertile isotopes such as U-238 and Th-232 basically require 2 neutrons to fission (one to convert, one to fission), and require fission reactions that generate more than 2 neutrons per absorption in a fissile nucleus.

4. For maximum safety, nuclear reactions should proceed in a thermal (slowed-down) neutron spectrum because only thermal reactors can be designed to be in their most critical configuration, where any alteration to the reactor configuration (whether through accident or intention) leads to less nuclear reactions, not more. Thermal reactors also afford more options for achieving negative temperature coefficients of reactivity (which are the basic measurement of the safety of a nuclear reactor). Reactors that require neutrons that have not been slowed significantly from their initial energy (fast-spectrum reactors) can always be altered in some fashion, either through accident or intention, into a more critical configuration that could be dangerously uncontrollable because of the increased reactivity of the fuel. Basically, any fast-spectrum reactor that is barely critical will be extremely supercritical if its neutrons are moderated in some way.

5. "Burning" uranium-238 produces a fissile isotope (plutonium-239) that "burns" inefficiently in a thermal (slowed-down) neutron spectrum and does not produce enough neutrons to sustain the consumption of uranium-238. "Burning" thorium-232 produces a fissile isotope (uranium-233) that burns efficiently in a thermal neutron spectrum and produces enough neutrons to sustain the consumption of thorium. Therefore, thorium is a preferable fuel, if used in a neutronically efficient reactor.

6. Achieving high neutronic efficiency in solid-fueled nuclear reactors is difficult because the fuel sustains radiation damage, the fuel retains gaseous xenon (which is a strong neutron poison), and solid fuel is difficult to reprocess because it must be converted to a liquid stream before it is reprocessed.

7. Fluid-fuel reactors can continuously strip xenon and adjust the concentration of fuel and fission products while operating. More importantly, they have an inherently strong negative temperature coefficient of reactivity which leads to inherent safety and vastly simplified control. Furthermore, decay heat from fission products can be passively removed (in case of an accident) by draining the core fluid into a passively cooled configuration.

8. Liquid-fluoride reactors have all the advantages of a fluid-fueled reactor plus they are chemically stable across a large temperature range, are impervious to radiation damage due to the ionic nature of their chemical bond. They can dissolve sufficient amounts of nuclear fuel (thorium, uranium) in the form of tetrafluorides in a neutronically inert carrier salt (lithium7 fluoride-beryllium fluoride). This leads to the capability for high-temperature, low-pressure operation, no fuel damage, and no danger of fuel precipitation and concentration.

9. The liquid-fluoride reactor is very neutronically efficient due to its lack of core internals and neutron absorbers; it does not need "burnable poisons" to control reactivity because reactivity can continuously be added. The reactor can achieve the conversion ratio (1.0) to "burn" thorium, and has superior operational, safety, and development characteristics.

10. Liquid-fluoride reactors can retain actinides while discharging only fission products, which will decay to background levels of radiation in ~300 years and do not require long duration (>10,000 year) geologic burial.

11. A liquid-fluoride reactor operating only on thorium and using a "start charge" of pure U-233 will produce almost no transuranic isotopes. This is because neutron capture in U-233 (which occurs about 10% of the time) will produce U-234, which will further absorb another neutron to produce U-235, which is fissile. U-235 will fission about 85% of the time in a thermal-neutron spectrum, and when it doesn't it will produce U-236. U-236 will further absorb another neutron to produce Np-237, which will be removed by the fluorination system. But the production rate of Np-237 will be exceedingly low because of all the fission "off-ramps" in its production.

12. We must build thousands of thorium reactors to displace coal, oil, natural gas, and uranium as energy sources. This would be impractical if liquid-fluoride reactors were as difficult to build as pressurized water reactors. But they will be much simpler and smaller for several reasons;

They will operate at a higher power density (leading to a smaller core),

They will not need refueling shutdowns (eliminating the complicated refueling equipment),

They will operate at ambient pressure and have no pressurized water in the core (shrinking the containment vessel dramatically),

They will not require the complicated emergency core cooling systems and their backups that solid-core reactors require (because of their passive approach to decay heat removal),

Their power conversion system will be much smaller and power-dense (since in a closed-cycle gas turbine you can vary both initial cycle pressure and overall pressure ratio).

In short, these plants will be much smaller, much simpler, much, much safer, and more secure. A fundamental mistake was made when thorium was overlooked as the prime nuclear fuel in favor of uranium. In such a position, there is some good company; Dr. Alvin Weinberg, former director of the Oak Ridge National Laboratory and inventor of the pressurized-water reactor (he holds the patent) said in 1970:

As all readers of Nuclear Applications & Technology know, the prevailing view holds that the LMFBR is the proper path to ubiquitous, permanent energy. It is no secret that I, as well as many of my colleagues at Oak Ridge National Laboratories, have always felt differently. When the idea of the breeder was first suggested in 1943, the rapid and efficient recycle of the partially spent core was regarded as the main problem. Nothing that has happened in the ensuing quarter-century has fundamentally changed this.

The successful breeder will be the one that can deal with the spent core most rationally—either by achieving extremely long burnup, or by greatly simplifying the entire recycle step. We at Oak Ridge have always been intrigued by this latter possibility. It explains our long commitment to liquid-fueled reactors-first, the aqueous homogeneous and now, the molten salt.

Only in the liquid-fluoride reactor can we find the safety, economy, and efficiency needed to unlock the potential of thorium energy for tens of thousands of years.”

Summary

We can;

Create 5+ million new jobs.

Generate these jobs inside the “Green” economy.

Diminish fossil fuel usage by 25% (with Thorium Nuclear 40+ %).

Save 30-50% of the electrical energy (with Thorium Nuclear 100%) now lost on the “grid”.

Make US buildings energy efficient without raising monthly budgets or down payments.

Increase every buildings value, utilizing capital now wasted in energy inefficiencies.

Give every building owner all available “green retrofit” tax credits and subsidies.

Preserve our environment and air quality.

Stimulate the overall economy of every community.

Do all of the above and preserve our capitalistic model without raising taxes.

But, we need your help to find a champion with some political clout.

If you have any suggestions, comments, referrals, edits or willingness to assist in bringing these solutions to your senator or to the public, email me at; www.kennedy200@sbcglobal.net

I will respond!

Implementation Concept by;

Patrick Kennedy, Public Relations

Thorium Energy, Inc.

KEYWORD REFERENCE: THORIUM, ENERGY, ATOMIC, NUCLEAR, RARE EARTH ELEMENTS, ALTERNATIVE FUELS, URANIUM, LEMHI PASS, ALTERNATIVE ENERGY, REACTOR, POWER, MINING, MINERALS, THORIUM, SHIELDING, SMALL REACTORS, KIRK SORENSEN, BLOGS ON THORIUM, NEWS ABOUT THORIUM, NUCLEAR TREATIES, INDIA POWER, THORIUM POWER, SSTAR REACTOR, NUCLEAR SUBMARINES, SALT WATER REACTORS, LIQUID FLORINE,LIQUID THORIUM, ATOMIC ELEMENTS, MINERALS, HADRON COLLIDER, COMMODITIES INVESTMENTS,THORIUM ENERGY, THORIUM POWER, ALTERNATIVE ENERGY, ATOMIC POWER, THORIUM-FUELED REACTORS, ATOMIC ENERGY, NON-WEAPONIZABLE FUEL, COAL, HYDROELECTRIC POWER, BURNING COAL, COAL AND CO2 POLLUTION , HYDRO-ELECTRIC POWER, WIND-POWER, SOLAR POWER, PETROLEUM ALTERNATIVES, OIL PRICES, COMMODITIES, RARE EARTH ELEMENTS, LEMHI PASS, MINING AND MINERALS, RISING OIL PRICES, OPEC, ENERGY INDEPENDENCE, THORIUM POWER IN INDIA, CANADA, CHINA GERMANY, ENGLAND, SWEDEN, SOUTH KOREA, FLORIDE REACTOR, ETHANOL, SHALE, SAND OIL, NUCLEAR SAFETY, THORIUM BLOGS, BIG OIL, THORIUM ENERGY BLOG, URANIUM, REACTOR SHIELDING, PLUTONIUM WASTE, GREEN ENERGY, GLOBAL WARMING, RESOURCES, RESERVES, MINERAL AND MINING CLAIMS, ATOMIC ENERGY, FISSION, FUSION, LFTR, DOUGLAS CASTLE, JACK LIFTON, CLEAN COAL, GREENHOUSE EMISSIONS, ENVIRONMENTAL FACTORS, RADIOACTIVE WASTE DISPOSAL, POLLUTION, GEOTHERMAL POWER, THORIUM-BASED ENERGY, THORIUM TECHNOLOGIES, RARE EARTH ELEMENTS, ENERGY RESOURCES, THORIUM SUPPLIES, REID-HATCH BILL, GREEN POWER, GREEN FUELS, KIRK SORENSEN, LIQUID FLORIDE THERMONUCLEAR REACTOR, TH, THORIUM OXIDES, COMMODITIES FUTURES, NON-PRECIOUS METALS, THE GLOBAL FUTURIST, CLIMATIC CHANGE, BLOGS ABOUT THORIUM, GOOGLE ALERTS ABOUT THORIUM, YAHOO ALERTS ABOUT THORIUM, THORIUM NEWS, INTERNATIONAL ENERGY POLICY, G-8, INDIA'S THORIUM, CLIMATIC CHANGE, BLOGOSPHERE...