For THE GLOBAL FUTURIST and THE TNNWC DAILY NEWS FEED by Douglas Castle

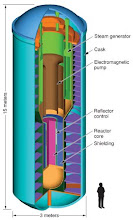

[Above Illustration Courtesy of CRAIN'S NEW YORK BUSINESS]

---------------

Dear Friends, Futurists and Entrepreneurs:

Wall Street and Washington (through the US Federal Reserve Board) tell us that their is no danger of inflation during the course of the "foreseeable future" and that key interest rates will be held stable in the absence of a threat and in order to aid in the economic recovery believed by many to be occurring within the United States.

The classical example of inflation ("Classic Inflation") is a decrease in the value of currency such that more of it is required to purchase the same goods as could be purchased with a lesser amount previously.

The picture that is frequently painted is that of some defeated man or woman pushing a bushel basket filled with paper currency (usually US dollar bills) to the supermarket in order to buy a loaf of bread.

A note of caution is in order -- a very misleading "seeming deflation" can be created in a situation where there is insufficient available income (amongst consumers) to purchase goods or services at any price. That is to say, by way of illustration, that if I am unemployed and you (an aggressive and optimistic real estate broker) are showing me a house that sold four years ago for $500,000 which is now on the market for a mere $50,000, I still won't buy it. The marketplace, driven by desperation from the "sell side" starts lowering prices in order to clear inventory, but, ironically, regardless of how low the prices fall, too few people have adequate money (due to unemployment, vanishing pensions, decimated retirement funds, and the like) to make these purchases at any price. And these prices are part of the market basket of goods and services that the government uses in order to determine inflation.

Theoretically (or actually), a nation can be experiencing "seeming deflation" even when the average family barely has adequate funds to pay for the barest of necessities.

In fact, because of business consolidations (where giant companies buy other giant companies, as in the case of Unilever negotiating to Purchase Alberto-Culver, or Southwest Airlines negotiating to acquire or merge with AirTran), marketplace competition is being eliminated due to fewer and fewer choices, and the consuming public is being increasingly faced with sharply rising grocery costs, airfares and the like -- as the quality of goods and services declines and as actual incomes and wealth decline. The reality is that when large companies combine, many jobs are lost.

Being a simple person myself, I look at the inflation situation simply: If I have lost my job, and I don't have any money, I cannot afford to subsist regardless of how much prices fall. I actually feel the full effect of inflation (i.e., I cannot put together enough cash to pay the mortgage, pay the note on the car and to feed my family) while the government is telling me good news about how we are in a period of either deflation or stabilizing prices...I cannot afford to send my children to college, and even if they were to get massive scholarships to most universities, they would not be able to get decent entry-level (or any-level) jobs upon graduation.

The tough reality on Main Street is that REAL inflation, the kind that severely and adversely impacts consumers, is actually climbing despite that CLASSICAL inflation (an economic notion that doesn't apply when unemployment and under-employment are quite high and continuing to increase). Using numbers, if my income decreases 100%, and the price of food remains 'stable' or increases 'modestly', I feel the same effect as if I were living in an economy where hyperinflation was in the newspaper headlines.

This situation does not improve if jobs are fewer and declining, but certain specialty positions are commanding higher salaries. If the interest rates charged by banks are at an all-time low but they are not making credit available to me, I cannot afford many of the necessary things which I purchased using credit before... things like my home, my car, my appliances.

When large stores which sell durable goods are advertising plans where you can purchase something today on a "layaway plan" where no payments are required for 12 or 18 months, and afterwards you (the lucky consumer!) can pay the balance off in non-interest-bearing installments, I do not see a great opportunity or a sign of economic recovery if I do not actually anticipate the ability to be able to make the first payments when they begin in a year and a half because I don't know if I'll be employed at that time. That is the reality.

I do not need to read The Financial Times or The Wall Street Journal once the prices of the things that they quote have become irrelevant to me.

No bargain is a bargain when I do not have a job, a positive prospect for a job, or any savings.

Broke is broke.

Forecast: Over the next 18 months, anticipate the following in the US, and in its industrialized European counterparts:

- More mergers and consolidations;

- Fewer permanent jobs, and a decrease in "real salaries" and "real income" (unless you work for Goldman...);

- Rising prices on necessities;

- A continuing reduction in the availability of consumer and small business credit;

- Marginal businesses failing at an increasing rate;

- A decline in the number of students graduating college, and a greater portion of students (at an older median age than that which had historically been associated with college attendance);

- An increase in taking a year or two off (to work, travel, or live off of their parents or with friends) after high-school;

- A significant increase in trade school advertising, and in people graduating with certificates instead of degrees;

- Fewer divorces (due to the expense); and fewer office or workplace extramarital affairs (due to the expense and the decline in workplace attendance);

- Declines in the quality of the customer service experience;

- Very expensive airfares;

- The beginnings of a precipitous rise in gasoline and fossil-fuel products -- an ominous sign of both REAL and CLASSICAL inflation on the way, and impacting the prices of everything;

- A sharp increase in the cost of healthcare and healthcare insurance;

- An increase in the percentage of suicides amongst two groups of segments of the population -- college-aged youth and Baby Boomers;

- An increase in crime across all categories;

- The disappearance of an increasing number of paper publications (mostly periodicals, journals and the like).

Those who will fare best will likely be: frugal trust-fund offspring of dynastic families; directors and executive officers of the largest corporations, especially financial, pharmaceutical and oil conglomerates; healthcare professionals; certain licensed tradespersons (plumbers, for instance); cerebrotonic computer geeks; and, of course, intrepid entrepreneurs --my favorite group of people, and my greatest hope for the future.

Where there is entrepreneurship, there is great hope. Hope is so very important.

Faithfully,

Douglas Castle, for

TNNWC Group, LLC (http://www.tnnwcgroup.com/) and The Global Futurist (http://theglobalfuturist.blogspot.com/)

---------------

Labels, Tags, Key Words and Reference Terms For This Article: unemployment, financial and investment trends, inflation, consolidations, mergers, prices, declining real income, Real Inflation, Classical Inflation, entrepreneurship,The Global Futurist, The National Networker Weekly Newsletter, DouglasCastleBlogosphere, business plans, business planning.