- Oil prices have climbed to an average $105.35 per barrel, with consequent price increases at the gasoline pumps;

- Unemployment statistics are on the rise as outsourcing and offshore continue to effectively export jobs, and eventually, entire industries;

- The Euro is fast overtaking the U.S. Dollar as the currency of choice for transaction payments and as a store of value -- The Euro is roughly worth 150% of the U.S. Dollar;

- New housing starts are declining, signaling the onset of a "classical" recession;

- There is a growing trend toward a flight to value from the equity and debt markets toward commodities and tangibles;

- Active discussions are taking place amongst lawmakers about the tremendous burden on the stability of our domestic economy imposed by our dependency on oil, and about government-sponsored incentives to be instituted for developers and providers of alternative energy sources;

Concurrently, and interestingly:

- Search engine inquiries (Google) regarding thorium (as a word or theme included in the searches) were greater in number from the period of 1st March to 15th March (e.g., the most recent half-month period) than during the three-month period immediately preceding it. Interest in Thorium is growing, as evidenced by the surge in request for information about thorium in various contexts;

- Search engine inquiries (Google) regarding the Rare Earth Elements (as a word or theme included in the searches, and not including searches for specific member elements of the Actinide Series or the Lanthanide Series) were greater in number during this same period than in the two-month period immediately preceding it. Interest in the Rare Earth Elements is also growing, based on the surge in inquiries;

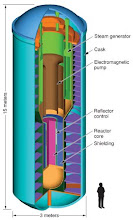

- Both private-sector enterprises and public-sector agencies are spending an increasing percentage of their total budgets on research involving Thorium and its capabilites as a reactor fuel (Floride Reactor, CANDU Reactor and variants, both existing and in the design phase) and as a readily available radiation shielding component for reactors. Various green-friendly organizations are "coming around" to endorsing thorium-fueled power because of its reduced transuranic waste profile -- this is important, as it perceived to be a less likely environmental pollutant and accelerant of Global Warming than any other serious, large-output alternative.

The United States, as well as numerous other nations throughout the world are looking increasingly to thorium. As a side note, a colleague mentioned to me several days ago, "Any day now, I'm expecting that gold will be worth its weight in thorium." I've been told that many a statement made in jest contains a significant element of truth.

Jack Lifton of RESOURCE INVESTOR has written a number of articles about thorium and the Rare Earth Elements. Direct links to those articles are set forth below. The most recent ones are first. Click on these articles and see if they don't seem increasingly prophetic, especially in light of the present economy.

http://www.resourceinvestor.com/pebble.asp?relid=41041

http://www.resourceinvestor.com/pebble.asp?relid=40856

http://www.resourceinvestor.com/pebble.asp?relid=40786

http://www.resourceinvestor.com/pebble.asp?relid=39820

You also might want to take a look at the economic highlights set forth in THE GLOBAL FUTURIST. Click on http://theglobalfuturist.blogspot.com/

When you have finished your review of this material, and you take a second look at the trends in the economy and in the energy sector, you'll want to dig into THORIUM ENERGY, INC. much more deeply.

--THORIUM ENERGY, INC.